The Ally Platinum Mastercard® offers a straightforward approach to credit that ensures no surprises, making it a reliable choice for those looking to manage their finances with confidence.

Designed to grow with you, this card is an excellent tool for achieving your credit goals while providing a range of features that enhance your financial security. With no annual fee and a variety of user-friendly benefits, the Ally Platinum Mastercard® stands out as a practical option for responsible credit use.

Whether you are building or rebuilding your credit, this card provides an accessible path to financial stability. Its features include automatic credit line increases and free online FICO® scores, adding to its appeal for those who prioritize financial health and transparency.

Key information about the Ally Platinum Mastercard®

How does the annual fee work?

One of the significant advantages of the Ally Platinum Mastercard® is that it has no annual fee. This feature eliminates the need for users to worry about an extra charge each year, allowing for better financial planning and savings. The absence of an annual fee reflects Ally’s commitment to providing a transparent and user-friendly credit experience.

How is the credit limit determined?

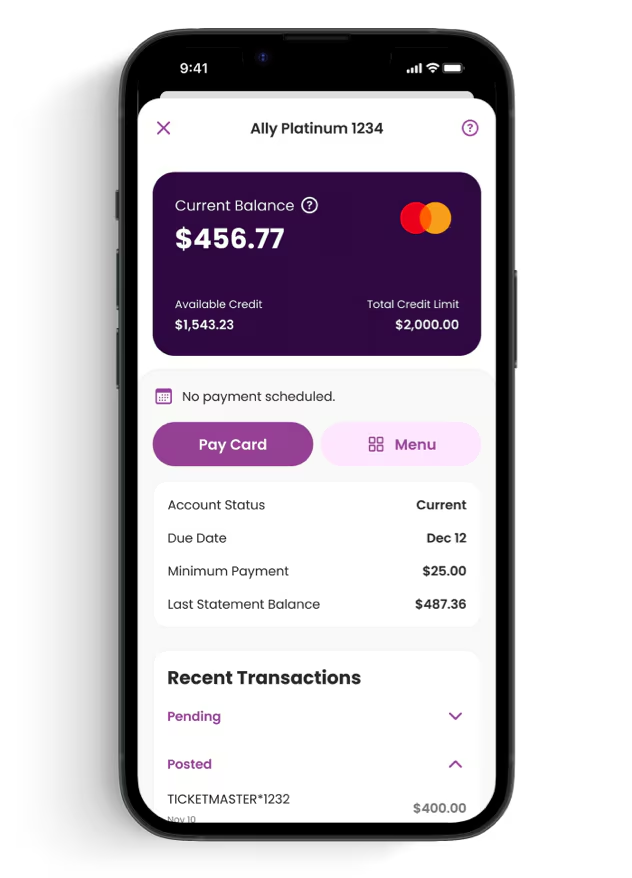

For traditional credit cards like the Ally Platinum Mastercard®, the credit limit is determined based on various factors, including your creditworthiness, income, and overall financial profile. Ally uses these elements to assess your ability to manage credit responsibly and assign a limit that aligns with your financial situation.

In the case of prepaid cards, the credit limit is not predetermined but rather set by the amount you deposit onto the card. This method gives you complete control over your spending limit, based on how much you choose to load onto the card.

Advantages of the Ally Platinum Mastercard®

The Ally Platinum Mastercard® offers several advantages that make it a compelling choice for many users. Here are some of the key benefits:

- No Surprise Fees: This card is designed with transparency in mind, offering no foreign transaction fees, no over-the-limit fees, and no returned payment fees. This ensures that cardholders can use their card with confidence, knowing there won’t be unexpected charges that could impact their finances.

- Automatic Credit Line Increases: One of the standout features of this card is the potential for automatic credit line increases. With responsible use, your credit line may grow over time without the need for frequent requests or negotiations. This can be particularly useful for managing larger expenses and improving your credit score.

- Free Online FICO® Score: Ally provides free access to your FICO® score through its online platform. This feature allows you to monitor your credit health regularly and stay informed about your credit standing. Having access to your score can help you make better financial decisions and track your progress over time.

- 24/7 Customer Care: Reliable customer support is available around the clock, ensuring that you can get assistance whenever you need it. Whether you have questions about your account or need help with a specific issue, Ally’s customer care team is there to support you.

- Zero Fraud Liability: The Ally Platinum Mastercard® offers Zero Fraud Liability, which means you won’t be held responsible for unauthorized transactions made with your card. This feature provides peace of mind and enhances your financial security by protecting you from fraud and unauthorized charges.

Highlighted advantage: Zero Fraud Liability

The Ally Platinum Mastercard® offers Zero Fraud Liability, which ensures that you are not held responsible for unauthorized transactions made with your card. This feature provides peace of mind, knowing that your financial security is protected around the clock.

Disadvantages of the Ally Platinum Mastercard®

While the Ally Platinum Mastercard® offers numerous benefits, it is important to consider some potential drawbacks:

- High APR Range: The card comes with a variable APR ranging from 22.99% to 29.99%, which can be relatively high compared to other credit cards.

- Balance Transfer and Cash Advance Fees: There are fees associated with balance transfers (4% or $5, whichever is greater) and cash advances (5% or $10, whichever is greater).

Highlighted disadvantage: High APR Range

The most significant drawback of the Ally Platinum Mastercard® is its high APR range. This can result in substantial interest charges if you carry a balance, making it crucial to pay off your balance in full each month to avoid high interest costs.

Who can apply for this card?

To apply for the Ally Platinum Mastercard®, you need to meet certain eligibility requirements:

- Minimum Age: Applicants must be at least 18 years old to apply for the card. This age requirement ensures that applicants are legally able to enter into a credit agreement.

- Income Requirements: A minimum income is generally required, though specific amounts may vary based on your credit profile. Ally assesses your income to ensure you have the financial capacity to manage a credit account responsibly.

- Credit Status: The card is accessible to a wide range of credit profiles, but it is ideal for those with fair to good credit. While the Ally Platinum Mastercard® is designed to be inclusive, individuals with less established credit may need to demonstrate financial responsibility to be approved.

How to apply for the Ally Platinum Mastercard®

Applying for the Ally Platinum Mastercard® is a straightforward process that can be done online, through the mobile app, or in person.

Online Application

To apply online, visit the Ally Bank website and navigate to the credit card section. Fill out the application form with your personal and financial information. After submission, you will receive a decision within a few minutes.

Mobile App Application

You can also apply using the Ally mobile app. Download the app from your device’s app store, log in or create an account, and follow the instructions to apply for the credit card. The app provides a user-friendly interface for managing your application and tracking its status.

In-Person Application

For those who prefer a personal touch, you can apply in person at an Ally Bank branch or a participating financial institution. A representative will guide you through the application process and address any questions you may have, providing a more personalized experience.